-

Website

-

3min Explainer Walkthrough

- Generate a Design

-

Page Management

-

Page Editing

-

Form Builder

- Updating Your Navigation Menu

- Creating Page Redirectors

- Posts Management

-

Search Engine Optimization

- Setting Up Google Marketing Tools

- Setting Up Meta Pixel & E-commerce Tracking

- Setting Up Microsoft Marketing Tools

- Setting Up Linkedin Insight Tag

- Optimizing Images For Web

-

Analytics

- Third Party Embed Code

-

3min Explainer Walkthrough

- Contacts

-

Marketing

-

Email Marketing

-

Automation

- SMS Marketing

-

Events Management

- Connecting Social Media

- Complying With Spam Laws (Australia)

- Changing Your Sender E-mail Address

- Change Links After Email Sent

-

Email Marketing

- Commerce

- Apps

-

Settings and Config

- Going Live

- Billing

- Domain Health Checker

- Managing Administrators

- Registering a Domain Name

- Changing Your Domain Name

- The Role of DNS Records Explained

- Backing Up Your Website

- Choosing an E-mail Host

- Hosting Email With Oncord

- Setting Up Gmail Hosting

- Setting Up Microsoft 365 E-mail Hosting

- Setting Up Sub Domains

- Hosting a Sub-Site

- Invoices, Receipts, Adjustments, Credit Notes & Refunds

- Website

- Contacts

- Marketing

- Commerce

- Apps

- Settings and Config

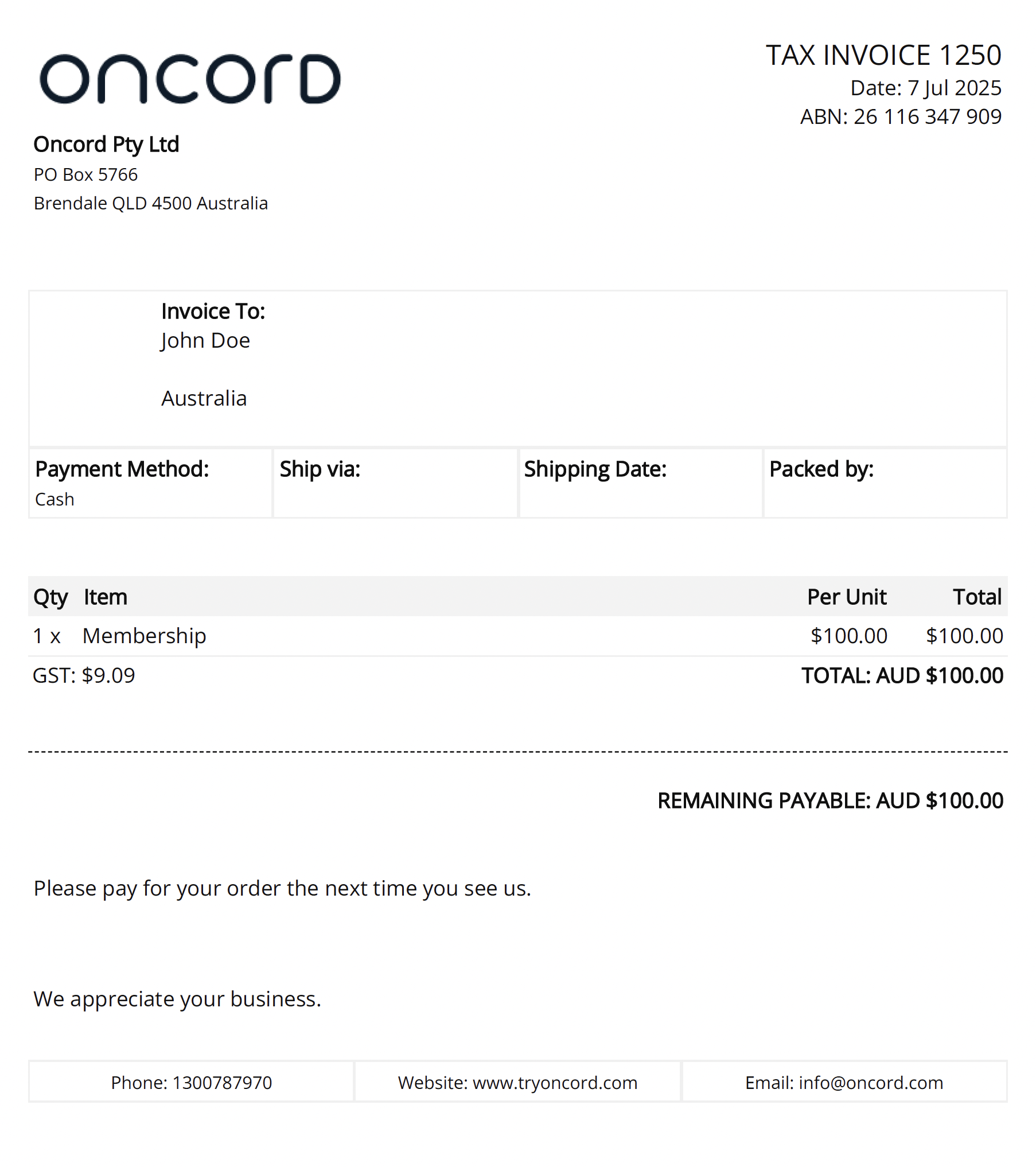

Invoices, Receipts, Adjustments, Credit Notes & Refunds

In this article, we'll explain the four key types of sales records in Oncord: Invoices, Receipts, Adjustments, and Refunds, and how they work together to keep your accounts clear and accurate.

Concepts Explanation:

Sales Invoices

A Sales Invoice is a formal document representing an order placed. It details the items or services purchased, quantities, pricing, and any applicable taxes. This document creates the expectation of payment from the customer.

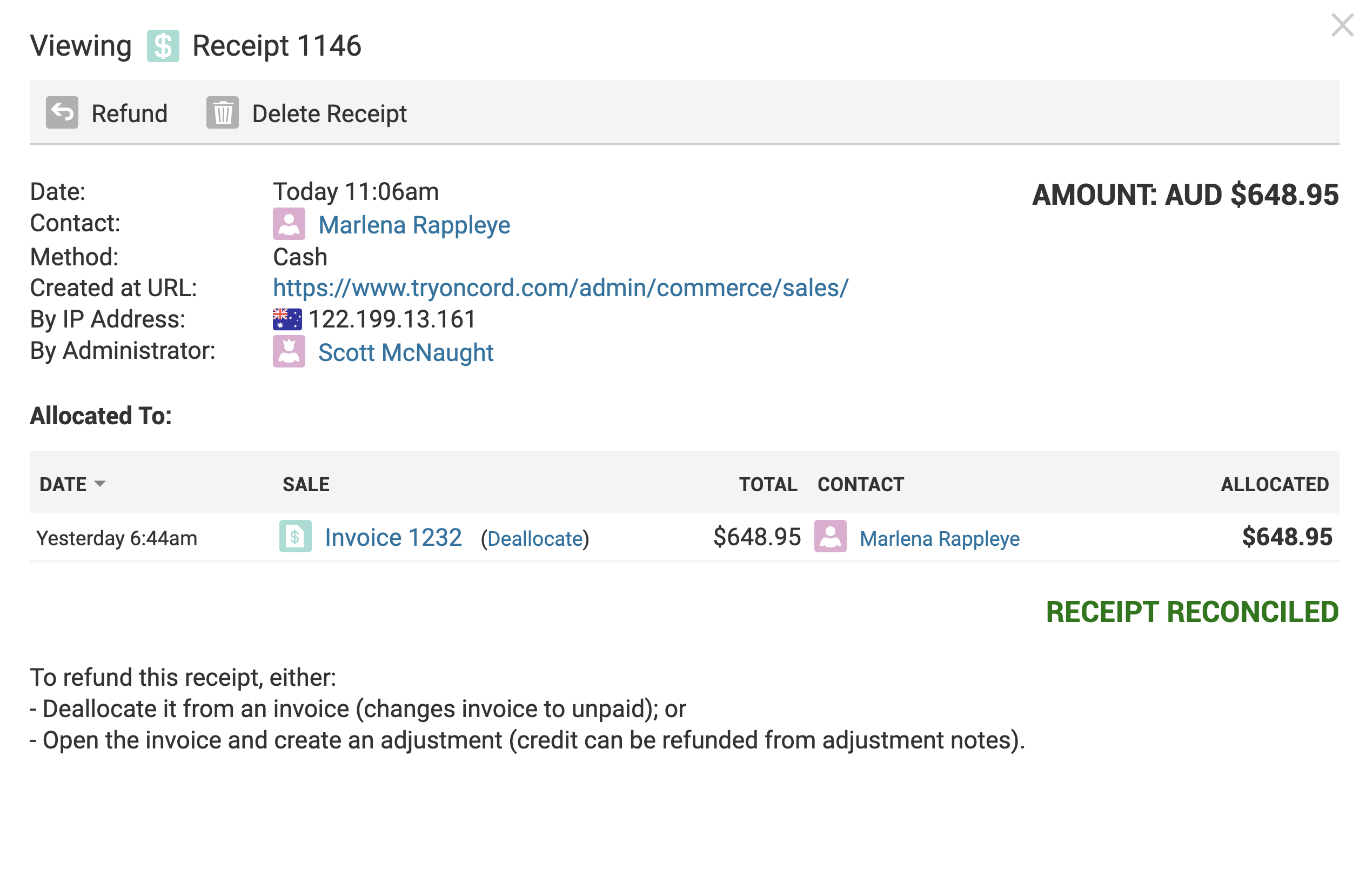

Receipts

A Receipt is issued once payment has been received. It confirms that funds have been successfully transferred and is often used for record-keeping and compliance purposes.

Adjustments

When you need to modify a sales invoice or refund a customer, this is done via Adjustments. Adjustments act as a counterpart to the original invoice, allowing you to revise previous transactions while maintaining a clean audit trail.

For example, if a customer changes their order, an adjustment invoice is created to reflect the new arrangement. You can remove or add items as needed.

If the value of removed items exceeds that of items added, credit is generated. This credit can be:

- Used by the customer for future purchases.

- Refunded directly to the customer.

Adjustments can also be used to:

- Apply a discount after a sale has been finalized.

- Correct mistakes in the original invoice.

- Provide a credit note for future use.

- Mark an invoice as bad debt.

Refunds

A Refund is represented as a receipt with a negative payment amount. This typically occurs when a customer returns items or when an overpayment needs to be returned.